Why Finverso?

Why Finverso?

Making Privately-Held Companies more Valuable

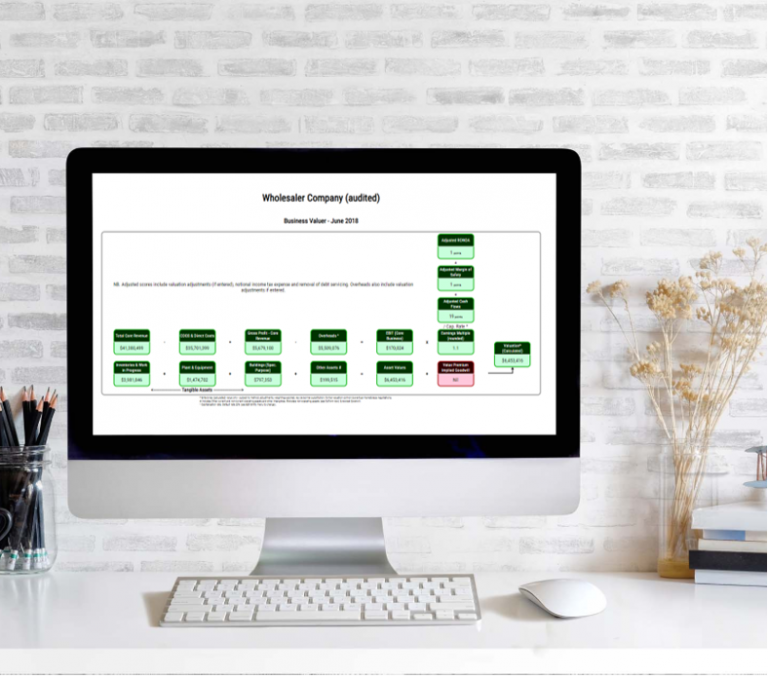

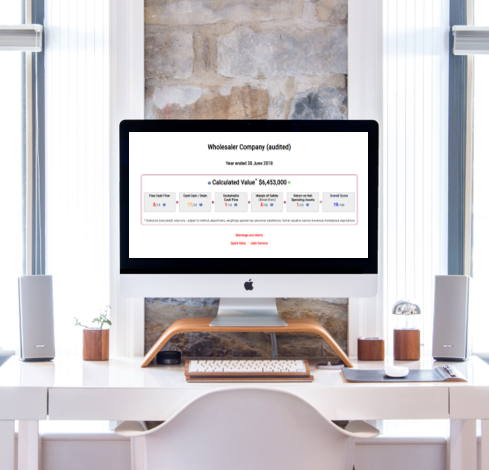

Business valuations are expensive and usually only undertaken when a transaction is imminent. We have found that shareholders appreciate on a regular basis an indicative valuation of their investment. Finverso continuously calculates an indicative enterprise valuation based on profitability and other key financial results including cash flows, margin of safety and return on assets. This means you can create focus and clarity on what matters most – Value Creation.

Accountancy doesn’t have to be complicated

Accountancy is a complex system – Finverso simplifies accountancy.

Finverso takes the difficulty out of financial governance by creating focus and clarity on what matters most. Through analysing financial reports, Finverso generates a score out of 100 that accurately depicts the financial performance of your company. With Finverso, it is possible to pinpoint areas of strength and weakness, unlocking new potential for privately held companies to grow in value.

Having Better Financial Conversations

Making financial governance more effective by turning data into insights and streamlining the complexities of financial governance.

At Finverso, we have long recognised that financial statements can be complex and difficult to interpret. Finverso automatically interprets financial reports into easy-to-understand information that directors, CFOS, and advisors to boards can utilise to create actionable conversations. That means less time struggling to present financial information and more time developing strategies that will lead to better financial conversations and business outcomes.

Making Privately-Held Companies more Valuable

Fill out the form and we’ll be in touch to discuss how Finverso can help your company or advisory practice.